It is an example of the concept of fixed tax. 301116 was a form of the poll tax.

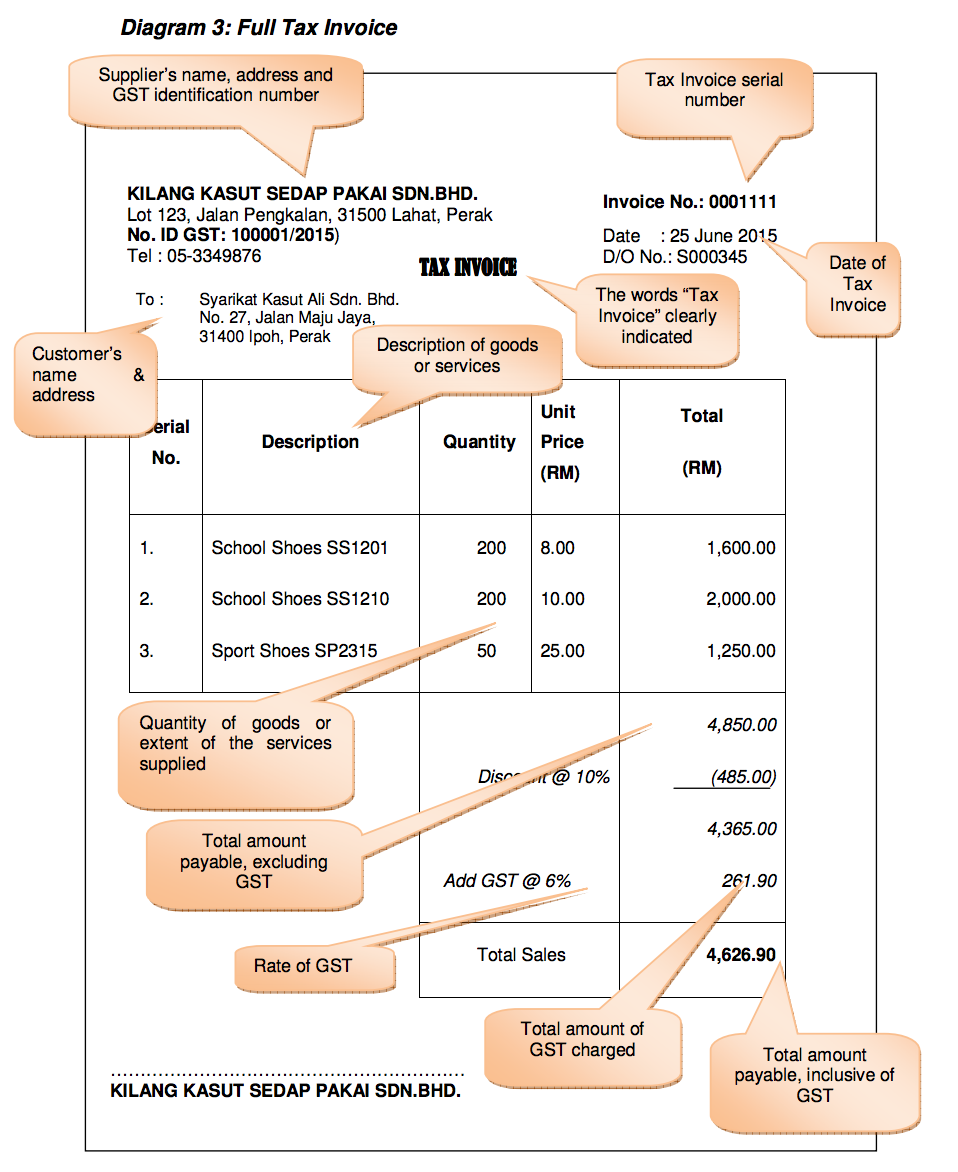

Basics Of Gst Tips To Prepare Gst Tax Invoice

Zip code and GSTIN.

. GST Calculator GST shall be levied and charged on the taxable supply of goods and services. A tax invoice is the invoice created by a GST registered business owner when he sells taxable goods and services. Segala maklumat sedia ada adalah untuk rujukan sahaja.

Penalty 100 of the tax due or Rs. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. From 1 st April 2015 to 31 st May 2018 Malaysia Passenger Service Charge PSC or Airport Tax for domestic and international air travel which is collected on behalf of Malaysia Airport Holdings Berhad or Senai Airport Terminal Services Sdn Bhd was subject to GST at the standard rate of 6.

Effective from April 1 2022 Indias nodal body for administering indirect taxes CBIC Central Board of Indirect Taxes and Customs had reduced the turnover limit for mandatory issuance of e-invoice electronic invoice under the goods and services Tax GST to INR 200 million US264 million from the earlier prescribed limit of INR 500 million US66. 10000 -whichever is higher if the additional GST collected is not submitted with the govt Penalty for not issuing an invoice. John can claim a GST credit of 100 on his activity statement.

By the Numbers. Goods and Services Tax the name for the value-added tax in several jurisdictions. The seller is registered for GST and charges John 1100 including 100 GST.

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021. Penalty 100 of the tax due or Rs.

More DOWNLOAD Download form and document related to RMCD. Penalty 100 of the tax due or Rs. Penalty for not registering under GST.

One response consisted of 385 words covering three topicspolitical reform the economy and the empowerment of youths racial minorities and womenThe answer proposed reforms to the Political Funding Act workers rights minimum wage the tax code and rules around Malaysian mothers with foreign-born children. The Authority for Advance Ruling under GST Maharashtra in the case of Basf India Limited- 2018-TIOL-82-AAR-GST dated 21st May 2018 has held that goods sold on HSS by the HSS seller is a supply which is not taxable under GST ie non. Each product has a unique HSN code which must be mentioned on the invoice.

Under the Internal Revenue Code 7201 any willful attempt to evade taxes can be punished by up to 5 years in prison and 250000 in fines. Goods and services tax Australia Goods and Services Tax Canada Goods and Services Tax Hong Kong Goods and Services Tax India Goods and Services Tax Malaysia Goods and Services Tax New Zealand Goods and Services Tax Singapore. 10000 whichever is higher.

Poll taxes are administratively cheap because. Name of the Act Late fees for every day of delay. Service Accounting Codes SAC is a unique.

State tax agencies have their own rule and many have more time to collect. Tax invoices are mandatory for claiming Input Tax Credit. One of the earliest taxes mentioned in the Bible of a half-shekel per annum from each adult Jew Ex.

10000 whichever is higher. For most tax evasion violations the government has a time limit to file criminal charges against you. Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017.

This excluded flights ex-LBU LGK and TOD as they. John can also claim an amount that reflects the decline in value of the photocopier on his tax return. Rs 25 Total late fees to be paid per day.

This is because the tax invoice not only enables the seller to collect payments but also avail input tax credit under GST regime. Central Goods and Services Act 2017. A poll tax also called a per capita tax or capitation tax is a tax that levies a set amount per individual.

The next section in invoice is the Bill to section which contains the details of your customer. HSN code is used to classify goods to compute GST.

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Get Gift Cards

Basics Of Gst Tips To Prepare Gst Tax Invoice

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

New Restaurant Cash Handling Policy Template Invoice Sample Invoice Template Word Invoice Template

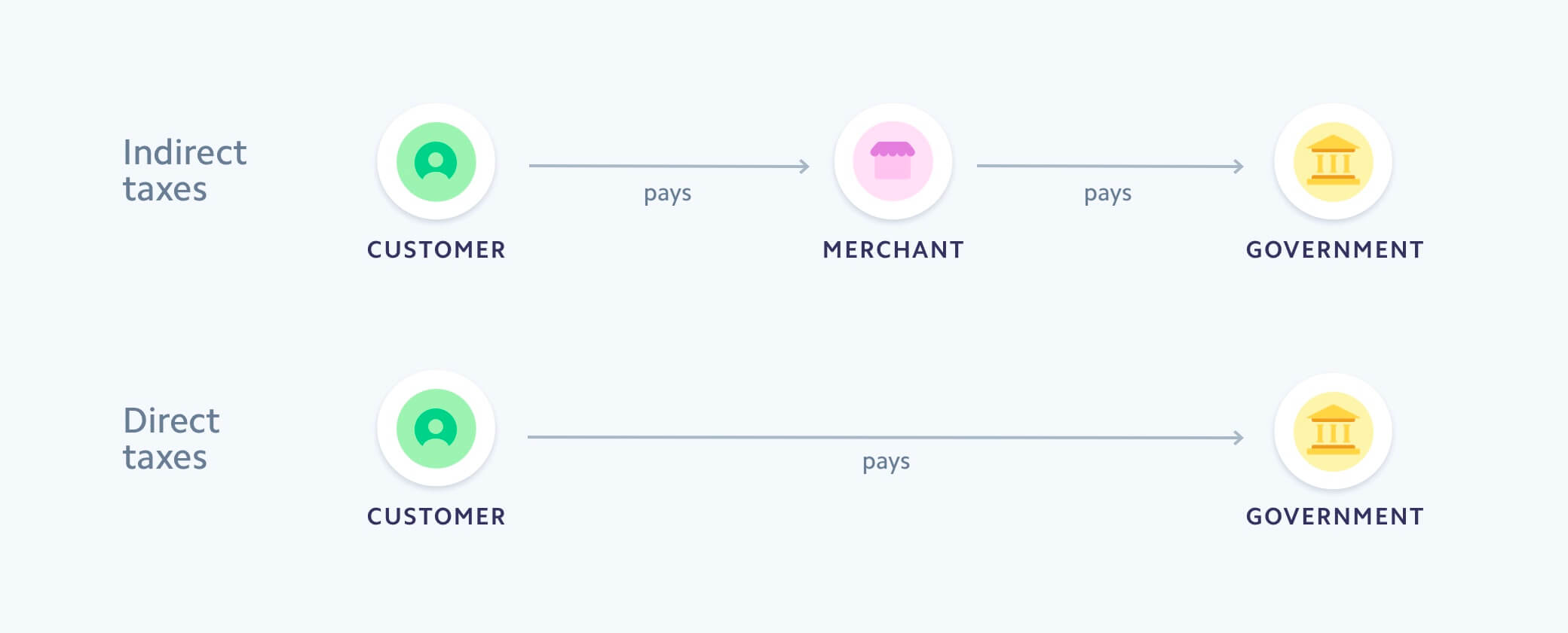

What Is The Difference Between Gst Income Tax

Non Deductible Tax Code Bl Sap Blogs

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Complete Sst System Setup Guideline Help

Yyc Advisors Recommended Gst Tax Code Listings For Supply Source Accounting Software Enhancement Towards Gst Compliance Revised As At 18 July 2016 By Customs Facebook

Introduction To Sales Tax Vat And Gst Compliance

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Deemed Supplies Scenarios Malaysia Gst Sap Blogs